Industry Knowledge

Fixing Financial Woes: A Quick Guide to Outsourcing Financial Services

Looking to outsource financial services? Consider these benefits.

Finance is a major contributor to the outsourcing business. According to Fortunly1, a whopping 71% of finance executives choose to outsource financial services, topping even retail and transportation firms. In 2021 alone, the global financial services outsourcing market was estimated to be worth an impressive 130 billion USD and is expected to grow 7.5% each year.2

With the wide availability of outsourcing services around the world, it’s no surprise that more and more companies are deciding to outsource various areas as general as fintech solutions to more specific functions like blockchain financial services.

Non-finance companies can also choose to outsource internal financial processes to reap its benefits versus in-house operations. But is outsourcing the right move? Is it worth it? Is it safe to entrust such an essential and sensitive aspect of your business to a third party? Let’s take a closer look.

What is Financial Services Outsourcing?

Financial services outsourcing is having an outsourcer handle or operate your business’ financial functions including (but not limited to):

- B2C and B2B Customer Support (phone, email, chat, social media)

- Technical Support

- Know Your Customer (KYC)

- Know Your Business (KYB)

- Payment Screening

- Fraud/Chargebacks/Disputes

- Business Transaction Monitoring

- Anti-money Laundering (AML) and Counter-terrorism Financing (CTF)

- Sales

Thanks to today’s robust BPO financial services offerings, practically any financial task or responsibility can be outsourced. In fact, many companies benefit from this, whether in the finance industry or otherwise.

Why Outsource Financial Services?

It’s normal to have hesitations towards financial services outsourcing, especially for a company that’s unfamiliar with outsourcing. After all, financial management is vital for every business; it can make or break a company. Large organizations looking to outsource, for example, might have doubts about whether finance BPO providers can handle—let alone understand—their complex systems.

However, outsourcing has come a long way. Remember that you’re going to be working with experts who deal with all kinds of clients, problems, and situations in their industry. This alone makes it more than capable of taking over any financial task or process of any scale and complexity.

Another thing to consider is that times are changing; technology is rapidly shaping how we handle money. As financial operations become more complicated and high-tech, it can be hard to keep up. Thus, a lot of businesses seek the help of finance BPOs equipped with the latest in financial technology (equipment, software, etc.).

Advantages of Outsourcing

Now that you understand the why of financial services outsourcing, let’s take a look at some of its specific benefits.

Better Business Decisions

Any business owner knows that the financial aspect of their operations requires a lot of attention and effort. It’s a demanding responsibility that is tedious and time-consuming. By removing the pressure of managing and running financial operations, both employees and decision-makers are able to perform better and make more sound business decisions. Having a finance BPO partner means that you always have an expert by your side—one you can regularly consult and work with in order to improve your results continuously.

Improved Cost Savings

One major reason companies turn to BPO financial services is that they allow you to identify cost-saving opportunities. For instance, having an in-house team of finance specialists costs a lot of money, especially for smaller and younger businesses. By choosing to outsource your in-house financial tasks, you can save a significant amount on hiring, training, supervising, and compensation. You can also reduce other major overhead expenses, such as utility and infrastructure costs.

Deeper Talent and Expertise

Once you outsource financial services, you gain access to a better and wider pool of talent. You can get the help of highly trained experts who will help you level up your operations and improve your overall business performance on a more global scale.. There’s no need to worry about consistency either, as credible finance BPOs have proven best practices in place for each process. Finally, you don’t have to worry about churn, as manpower can be under the full responsibility of your partner.

More Funds and Manpower

By cutting down on overhead costs, you have extra funds—money you can invest in other things such as marketing campaigns and corporate social responsibility initiatives. With a less-burdened workforce, you can focus more on the bottom line and other key deliverables.

Upgraded Technology

With a reputable finance BPO as your partner, you gain the benefits of state-of-the-art infrastructure, equipment, instruments, software, and other technological assets specifically designed for financial solutions. In today’s digital age, you can benefit from advanced tech like real-time accounting, automation, advanced financial modeling, and so on.

How to Find the Right Financial Services Partner

Choosing the right outsourcer to work with is just as important as deciding to outsource in the first place. Before pressing the button, do your research; carefully consider whether your potential partner finance BPO can handle your requirements and expectations if it has the credentials to prove it. Here are a couple of things to look out for:

Absolute Trust

Outsourcing entails transferring sensitive financial documents and turning over confidential processes, leaving your organization vulnerable to security breaches and non-compliance in terms of government and privacy regulations. To avoid this, choose your financial services outsourcing provider wisely—select one that is credible and experienced in the industry.

Transparency and Clear Communications

Outsourcing your financial processes to a finance BPO typically involves working with a team in another country—likely even in another continent. This means that you can’t be as hands-on and direct as you would be able to with an in-house team. This is why it’s important to pick a partner you can continuously collaborate with. Set clear expectations and establish a communications framework that works for you both.

Financial Services Outsourcing Redefined

Financial Services Outsourcing Redefined

Finding a BPO financial services provider that is trusted, reputable, and flexible is crucial to achieving successful results. Fortunately, you don’t need to look any further.

Recognized by the Everest Group as the World’s Fastest Business Process (outsourcing) Service Provider, TaskUs is committed to helping you seamlessly outsource your financial operations. Our finance BPO offerings consist of innovative digital CX, consulting, and compliance and risk management solutions to stay ahead of increasingly complex fraud schemes and financial crime threats.

Safeguard you brand’s equity and customer experience from nefarious actors, threats, and theft to bolster your financial crime risk management.

KYC, KYB, KY-Everything. Verify everything you need to know about your users, sellers, merchants, and creators in one of our most thorough financial risk management services.

From Anti-Money Laundering to Sanctions Screening and Risk Assessments, reduce the burden of regulatory complexity through compliance services best practices in people, processes, and technology.

Achieve long-lasting brand loyalty and unmatched value through industry-leading, digital customer care.

Protect your customers’ identity, privacy, and investments through leading technologies and transaction monitoring processes.

Develop comprehensive, impactful, and digital customer strategies tailor-fit to your business objectives, growth plans, and customer platforms.

CASE STUDY

Fraud Prevention and Transaction Monitoring for A Cryptocurrency Exchange

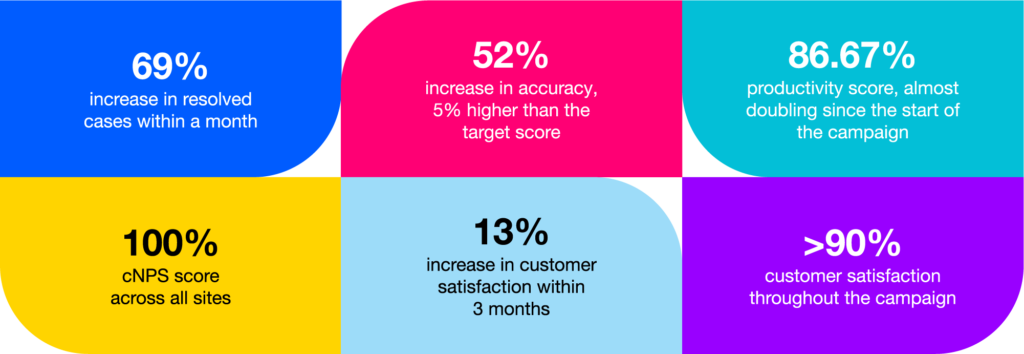

Download the full case studyOne of our clients is an American cryptocurrency company that needed a fraud prevention team as it expanded its services and catered to the growing customer demand. With quality being a primary focus, Quality Analysts were trained according to the client’s operational framework that followed internal metrics and parameters focused on Process, Policy Compliance, Workflow Picklist, Thorough Response, Message Tone and Structure, and Grammar and Language, all of which resulted in the following:

At TaskUs, we believe that a company’s success is determined by its people. Our employees are our greatest asset, and we’re committed to attracting and retaining them through our people-first culture. The Ridiculously Good formula for outsource financial services is You + Us.

- 2^Rise Of Financial Outsourcing

References

We exist to empower people to deliver Ridiculously Good innovation to the world’s best companies.

Services