Industry Knowledge

CX Summit Recap: Addressing Financial Fraud and Bad Actors

At the TaskUs CX Summit 2022, Risk+Response leaders shared strategies to combat the growing risks of financial crime compliance and fraud prevention.

For those of you who attended this year’s CX Summit in New York, it was an excellent opportunity to connect with business leaders and contacts after a three-year hiatus from our annual in-person event. This year’s theme centered on building a resilient business amid recent economic trends and turmoils. Speakers and panelists from the technology, retail, and financial services industries shared their strategies for staying competitive and retaining workforces amid uncertain market conditions.

As part of the summit, the TaskUs Risk + Response team sat down with John Matas, Director of Risk & Fraud Operations for Etsy, to discuss the growing challenges and opportunities in financial crime compliance and fraud prevention. The panelists and participants discussed budget prioritization and internal awareness efforts to combat fraud, technology innovations such as case management platforms and RPA automation, as well as emerging fraud typologies.

The Rise of “Friendly Fraud”

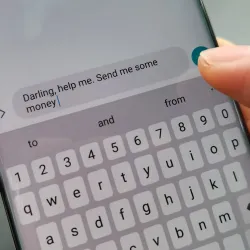

After two years of the COVID-19 pandemic, online commerce continues to shift, evolve, and surprise. Customers’ increasing preference to purchase goods and services through online platforms and marketplaces brings new and severe challenges, like the rise and growing complexity of “Friendly Fraud.”

On the surface, the term “Friendly Fraud” may seem harmless at first, but rest assured that there’s nothing “friendly” about this growing trend. Friendly Fraud, as defined by fraud.net, “typically involves an actual consumer obtaining goods or services from a merchant, then claiming they did not make the purchase, did not receive the goods, request a refund from a false claim, or only received a fraction of the items, to keep the goods or services without paying for them.”

The repercussions of Friendly Fraud (an estimated 20% growth YoY from 2019 onward per LexisNexis) include surges in disputes, triage, and chargeback fraud schemes that span the range of individual perpetrators to more complex organized crime rings. They have left the e-Commerce platforms and marketplaces to combat those responsible.

According to the True Cost of Fraud study, every $1 of fraud now costs U.S. retail and e-commerce merchants $3.75, reflecting nearly a 20% YoY increase in fraud costs since 2019. To counterbalance this, merchants and platforms alike are turning to highly dynamic anti-fraud, KYC, and further identity verification measures to help combat this growing trend of losses. Arming your fraud teams with an efficient system can help your organization weather the storm now, and into the future.

The rise of technology to help monitor and support both the merchant and customer sides allow for the implementation of additional safeguards like delivery verification (photos, date/timestamps) and documented system recording (purchase information, transaction timestamps and details, and historical customer purchase information that includes things like location, product/service type, and many other defining characteristics). This is to ensure your teams have the crucial information available to them in the event of a fraudulent transaction, chargeback/dispute, or, in some cases, both simultaneously.

Prioritizing Your Resources

Fraud rates are climbing steadily at a conservatively estimated rate of 20% per year. Coupled with the uncertainty of a recessed economy, simply throwing additional money and resources at the problem isn’t in the cards for most organizations. Many are attempting to practice one of the TaskUs core values—“Doing More with Less”—something most would deem “uncomfortable” to say the least.

As John walked us through a few anecdotal solutions, the common theme of prioritization and realistic expectations weaved their way throughout the segment. The takeaway when it comes to plateaued or possibly shrinking budgets is two-fold. The first is to analyze where your weak points are within your program. Figuring out how to prioritize your organization’s needs will help align your efforts and set realistic expectations while establishing specific focus areas when securing your organization’s overall risk probability.

The second area is recognizing that anti-fraud measures are never a zero-sum game.

While historically seen in some institutions as a cost center, fraud programs can withstand the initial write-off through specific and ongoing reporting. Showing the results of your program’s initiatives and efforts can help realign the conversation from “cost center” to an integral piece within your organization’s operational model and drive real results to your company’s bottom line.

When you optimize both sides of this coin, you’ll find a strong business case to stand beside amid growing fraud complexities, regulatory requirements, and evolving schemes.

The ORC Phenomenon

While Organized Retail Crime (ORC) is not a new phenomenon, there’s a new wrinkle in the playbook. In recent years, we’ve seen online platforms innovating how they serve customers and developing new methods to reach underserved or previously unserved customer bases. While the value added is clear to most consumers, these new service models come with their own compliance challenges for these platforms.

One of the focus areas is around the complex and organized fraud schemes emerging on both buyer and seller fronts. While incidents are more common on one side or the other, there’s been an interesting uptick in buyer/seller collusion.

Instances have been reported where a buyer and seller work together to defraud a platform through fictitious or fraudulent transactions allowing either side to file a chargeback or dispute normally ends with the platform holding the bag. This has become a more common scenario for illicit actors attempting to clean dirty money by structuring fraudulent sales and purchases.

In some cases, the perpetrator on both sides turns out to be the same individual or group where the seller poses as the buyer, “purchases” the service or product from the seller, and then files a non-delivery or other fraudulent claims, resulting in a refund from the platform used to host the transaction. The money is sent directly into a shared account, and the seller then moves to another account to hide the money.

Due to the nature of chargebacks and disputes, criminals have also found that going directly to the credit card issuer or platform is a more efficient way to scam and defraud their way to an easy payday through the manipulation of return and refund services offered by both.

The key takeaway from this growing phenomenon is that documentation and recording are essential. Similar to the chain of custody tracking in Law Enforcement evidence, accurately tracking and monitoring the movement of goods and services in your e-Commerce platform reduces the risks of an ORC outbreak on your platform.

Closing Thoughts

In a stressed economic environment, the motivation of illicit actors and those desperate enough to attempt to commit financial crimes continues to rise. It’s a perfect storm that can be the source of significant pain for platforms and companies that are ill-prepared to handle the uptick in attempted crimes. The key to staying ahead is to arm your teams with the necessary means to combat these crimes and proactively protect users from falling victim to them. Reporting and prioritization of resource allocation allow you to develop typologies and stay ahead of trending schemes. And most importantly, as the world continues to reopen in the wake of the recent pandemic, information sharing is of the utmost necessity.

Networking at events like the recent CX Summit allows professionals to share insights, experiences, and recommendations on the problems we all face.

References

We exist to empower people to deliver Ridiculously Good innovation to the world’s best companies.

Services